5 Best Hacks to Combat Rising Costs and Shrinking Profits

Discover the steps you can take to weather tough times, from cutting costs without cutting quality to making money...

8 min read

By:

Cubeler en-ca

2-Feb-2023 3:00:00 PM

Whether Canada's economy sees a soft landing, sharp downturn, or lands somewhere in between, take a step back, focus on the challenges you can control, plan for the year ahead and pivot to the best recession-proof SME ideas for 2023.

Predicting the trajectory of Canada's economy in 2023 is anybody’s guess. It could be a “soft landing,” a sharp downturn, or land somewhere in between.

Add a dash of economic uncertainty and, voila, it suddenly gets very difficult for SMEs to make plans for 2023. More now than ever, it's crucial for business owners to take a step back and plan for the year ahead.

Sure, it's easy to get caught up in the worries and challenges that the economy may bring. Don’t. Approach 2023 with a balanced perspective: acknowledge and prepare for any economic challenges, but don't let them consume all your time.

Instead of getting overwhelmed by “doom and gloom” headlines, focus on the challenges you can control, devoting all your time and energy to tackling them.

During any economic cycle, even a recession, the best defense for potential business challenges is a proactive offense. If your business could benefit from a change, consider pivoting to the best recession-proof SME ideas for 2023.

Reality check: expect a slowdown—not a recession

In 2022, most SMEs went from wondering if the pandemic was over to worrying about the very real possibility of a recession.

Fortunately, Canada has not yet entered a recession. Although the Canadian economy has been struggling lately, it has proven to be resilient. Nevertheless, 2023 could be marked by slower growth and plenty of uncertainty. The reason? The Bank of Canada’s interest rate hikes.

So why is the Bank of Canada and other major central banks hell bent on hiking rates? Because the risk of raising rates too little to control inflation is greater than the risk of hiking them too much, too quickly—even if the result is a sharp downturn.

Whether or not there will be a recession, milder-than-expected recession, sharp dip or quick recovery, the consensus is that the Canadian economy will slow down in 2023.

According to the latest Main Street Quarterly report by the Canadian Federation of Independent Business (CFIB), “slowing inflation, slow economic growth and no recession for Q1 2023” are in the cards for Canada’s economy.

The big question now: how will the economy handle more interest rate hikes from the Bank of Canada?

Despite the potential for a major downturn, there’s still a chance for a soft economic landing if Canada’s policymakers apply the right level of monetary tightening.

Many experts expect the Bank of Canada to eventually hold off on raising interest rates in the coming months to allow previous hikes to fully take effect.

Since the Canadian economy remains solid, Canada could, as a result, see a period of stagnation instead of a contraction.

“Our most plausible scenario is the Canadian GDP growing by 0.5% in 2023, with one or two negative quarters here and there,” says Pierre Cléroux, Vice President of Research and Chief Economist at BDC.

Otherwise, Canada is in a favorable position to manage its own economic destiny, as long as the slowdown comes from interest rate hikes rather than any external shocks.

Top 10 recession-proof SME industry ideas

With multiple economic experts predicting a downturn in the near term, the concept of a business that can withstand a recession may appeal to you.

Today, certain industries are known as “recession-proof”—since they can survive economic recessions, remaining stable and profitable despite challenging conditions.

If you're thinking about starting or expanding your SME, exploring business ideas with the potential to stand up to an economic downturn, and even flourish during periods of growth, is a smart place to begin.

To get you started, we've compiled a list of the “Top 10” recession-proof industries:

1. Healthcare

Since our health needs do not wait for a recession to end, the healthcare industry is well-suited to weather economic downturns—simply because people's health needs do not take a vacation during a recession. So, it's no surprise that healthcare is often cited as one of the most recession-proof sectors.

One caveat: Individuals with high insurance policy deductibles may be less inclined to seek out non-essential private medical services—such as cosmetic surgery and other elective procedures—during tough economic times.

2. Food, Grocery and Beverages

The food, grocery and beverage sectors are known to be quite resilient during economic downturns for a simple reason—people always need to eat.

One caveat: During a recession, consumers may be more inclined to cut back on expensive dining experiences, leading to more opportunities for SMEs that offer affordable food options.

3. Courier, Freight and Logistics

The courier, freight and logistics industry can leverage data to adjust their services and meet any market demands, making them well-positioned to weather economic downturns.

With eCommerce’s ever-evolving role today, the freight industry has essentially become the backbone of the economy. Even when retail sales decline during a recession, the need for these services remains unchanged.

Starting an SME in this sector, particularly a business that focuses on local economic activity, can be a smart choice, because these services cannot be outsourced to cheaper labour markets outside the region.

4. Contractor, Repair and Automotive

The contracting, repair and automotive industries can typically resist the negative effects of an economic downturn, since consumers tend to avoid buying new homes, cars or appliances during tough economic times. Instead, they rely on contractors, mechanics and other repair professionals to keep what they already own in working order. The need for contracting, repair and automotive services, as a result, remains constant, regardless of the economy.

One caveat: Not all industries related to contracting fare as well during a recession. Construction spending has been known to drop during economic downturns, especially when interest rates are on the rise. While people will always require repair services, they may be more hesitant to invest in new properties during recessions.

5. Academic and Education

Despite high tuition costs, education is known to be a relatively recession-proof sector. When job losses occur during a recession, many individuals often choose to go back to school to enhance their professional skills, which leads to increased demand for higher education.

The academic and education sector's resilience may be partly due to the availability of student loan and bursary programs that make education more accessible—despite the potential long-term financial burden on students.

6. Accounting and Finance

When thinking of recession-proof industries, accounting and finance may not immediately come to mind. Nevertheless, these sectors still see demand during economic downturns—people always require accounting services such as tax preparation, estate planning and bookkeeping.

Additionally, consumers and businesses alike require access to financing, whether it's credit cards, car loans, business loans or other lending solutions. The need for financial products does not vanish during a recession.

One caveat: Financial services companies that take on excessive risks may be particularly vulnerable during an economic downturn. Remember investment bank Bear Stearns? It closed its doors due to the “Great Recession” of 2008.

7. Information Technology and Software

During a recession, many established businesses may find themselves struggling to maintain their current operational structure. As a result, they may turn to automation and technology to reduce costs and stay afloat.

This trend can benefit IT and software companies. SMEs that can help other businesses modernize how they communicate, store information and operate have what it takes to weather a recession.

One caveat: The technology industry is not entirely immune to economic downturns and can also be affected by post-bubble woes, leading to significant asset price drops.

8. Digital Marketing Services

During economic downturns, businesses often reduce their advertising budgets. Digital marketing can serve as a cost-effective alternative to traditional marketing channels.

Through pay-per-click campaigns, social media marketing and search engine optimization (SEO), digital marketing agencies enable businesses to target specific market segments to sell their products. Additionally, digital marketing businesses typically have lower overhead costs, contributing to their recession-proof qualities.

One of the biggest expenses for many business owners is labour costs, but digital marketing companies can take advantage of the gig economy, hiring freelance web designers, copywriters, SEO managers and other staff to keep labour costs low.

9. eCommerce and Dropshipping

Retail can be a challenging industry during economic downturns, but eCommerce and dropshipping provide a way to run a retail business without the heavy financial burden of classic brick-and-mortar operations.

Traditional retail operations often have significant expenses such as rent and full-time employees, which can put a strain on finances when consumer demand decreases.

eCommerce businesses, on the other hand, can operate with a more streamlined business model, minimizing their overhead and allowing them to weather economic challenges, even when consumer demand plummets, making eCommerce businesses recession-proof.

10. Consumer Staples

Consumer staples, such as everyday necessities, tend to perform well during economic recessions. This is because these goods are essential and always in demand, even during difficult times when people may be out of work or struggling financially.

Products like toothpaste, soap, and shampoo continue to be purchased regularly during recessions or emergencies such as pandemics. This is why discount stores often thrive during these times, since their staple products are less expensive and become more attractive to consumers who are looking to save money.

Although these 10 industries can typically sustain the challenges of a recession, it’s important to remember that the businesses within these industries still need to run their companies efficiently and responsibly to weather any economic cycle, let alone a recession.

5 ways to pivot to 2023’s best recession-proof SME ideas

Charles Darwin had it right when he said, "It is not the strongest of the species that survives, nor the most intelligent that survives—it is the one that is most adaptable to change."

In times of crisis, new opportunities and innovations typically bubble up to the top, and the SME owners that can pivot their businesses and adapt to these changes will be the ones that thrive.

A powerful idea can be the spark you need to move forward. Many successful SMEs have undergone multiple pivots, and while it can be daunting, it can also be a time of growth and expansion. Now’s an opportunity to explore new possibilities.

Below are five ways to pivot to the best recession-proof business ideas:

1. Embrace the digital age

If you run a brick-and-mortar business, it’s essential to find ways to adapt to the digital world. Consider the potential of delivering your products or services electronically. With the increasing demand for online content, ask yourself how you can adapt your business to provide value in the digital space.

2. Leverage your current resources

By aligning your resources with the current needs of your customers, you can identify new opportunities for your business. Identify the current needs of your target audience to rethink how your company can meet them with your current resources. Consider pivoting to a digital or recession-proof business model. Explore new business avenues.

3. Foster greater customer loyalty

Be transparent about your efforts to pivot to new ventures and meet the needs of your customers the best you can, giving them the chance to back you in return. Loyal customers can become the best advocates for your brand, so it’s crucial to maintain a strong relationship with them. Show them that you value their support and trust.

4. Discover the power of collaboration

As one African proverb suggests, "If you want to go fast, go alone. If you want to go far, go together." Collaboration can bring new ideas, create synergies and open up opportunities to pivot to new business ventures. Partnerships can also provide access to new customers, products and markets. Now, ask yourself: What current partnerships would be mutually beneficial to my business?

5. Experiment, fail, repeat

Be open to experimentation, pivoting and launching new ideas. The key is to focus on results and learn from each iteration. Not every attempt will be successful. Failing is part of the process, so it's important to keep moving forward. It may take multiple tries to find the right pivot for your business, but persistence often pays off in the long run. Remember that even successful companies like YouTube started as a video dating site before finding its true niche.

Now it’s time to pivot

It's important to remember that every recession, soft landing or mild downturn is unique, so it can be challenging to predict its impact on different industries.

Nevertheless, companies in "recession-proof" industries typically see steady consumer demand for their products or services and have minimal expenses—during any economic cycle.

By identifying the key strengths of recession-proof industries, you can apply a proven pivot strategy to your current business or incorporate this approach into a new venture, helping safeguard your success, in good or bad times.

Naturally, it’s tough to pivot your business in the face of adversity. Before pivoting, consider the financial implications. It's not always easy to reset your company, and it's important to have the financial resources to make the transition.

If you’re looking to start a new business or keep your SME on sure footing—financially speaking—find out how to fast-track your way to small business loans and other financing solutions—via the Cubeler Business HubTM.

Quick takeaways

Here’s how to pivot to 2023’s best recession-proof SME ideas:

Now more than ever, it's crucial for SME owners to take a step back and plan for the year ahead, no matter where Canada's economy is headed.

Instead of getting overwhelmed by “doom and gloom” headlines, focus on the challenges you can control, devoting all your time and energy to tackling them.

Whether the economy sees a soft landing, sharp downturn or somewhere in between, consider pivoting to 2023’s best recession-proof ideas now.

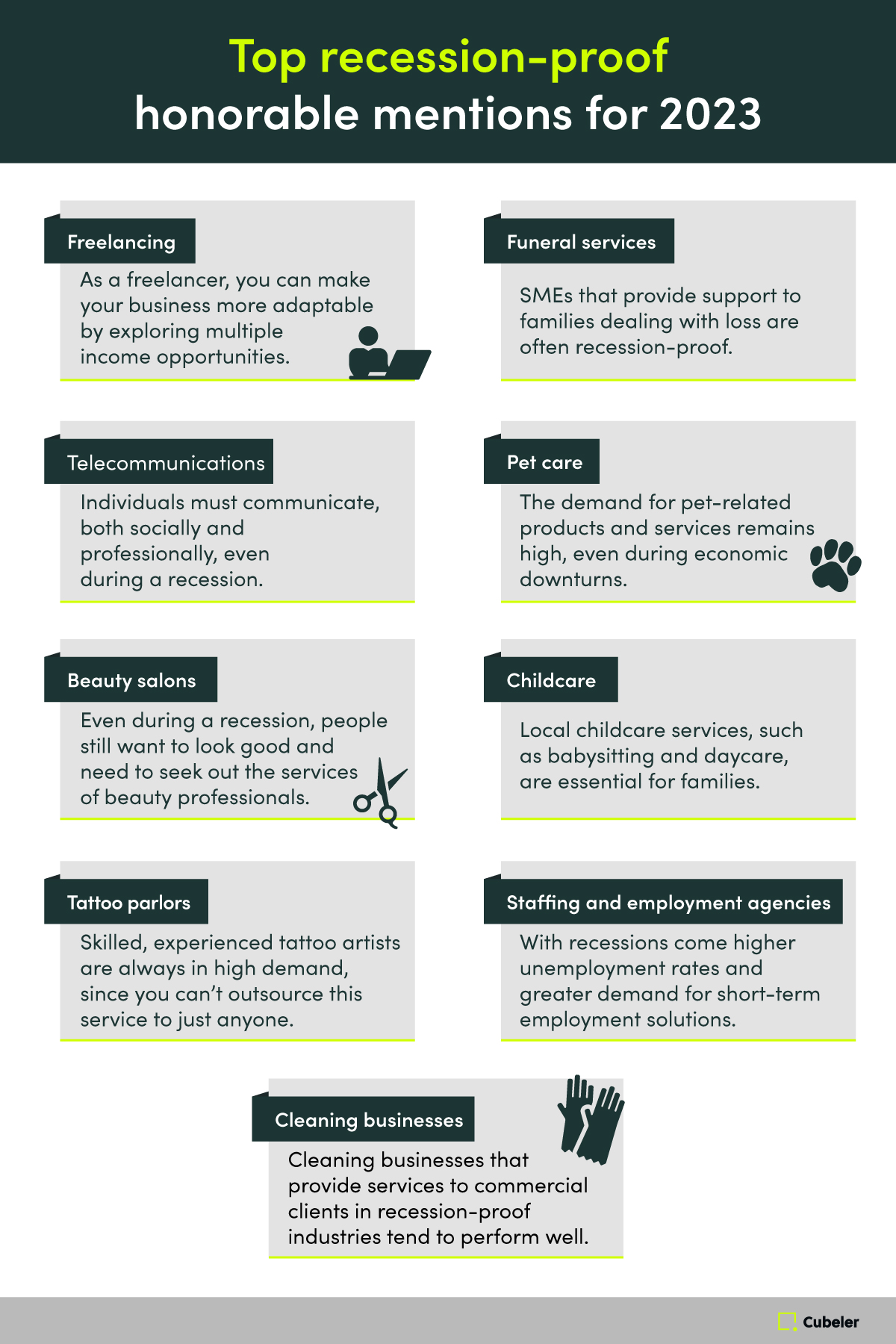

Pivot to industries known as “recession-proof”—like healthcare, food, beverages, freight, automotive, education, accounting, IT, digital marketing, eCommerce, dropshipping and more.

There are five ways to pivot to the best recession-proof SME ideas: Embrace the digital age, leverage your current resources, foster greater customer loyalty, discover the power of collaboration and experiment with new business avenues.

Learn how to improve candidate targeting and outreach while reducing employee turnover with Cubeler’s quick-guide to...

Access LGBTQ+ resources for startups in Canada.