Unlock the Power of Marketing: Get Your Free Marketing Plan Workbook

Enhance your marketing expertise with our free Marketing Plan Workbook, tailored specifically for small business owners...

6 min read

By:

Cubeler en-ca

29-Mar-2023 9:00:00 AM

Leverage the latest shifts in consumer behaviour and digital marketing to stand out from your competitors, engage your customers and, ultimately, drive them to your eCommerce site.

When we hear the word “reinvention” in the business world, we think of individual brands evolving to keep up with the competition or satisfy ever-changing consumer and industry trends.

Famous examples that spring to mind include Amazon transforming from an online bookstore to a digital retail juggernaut in the mid-90s, or National Geographic evolving from a monthly magazine into a multifaceted media giant during the early 2000s.

A whole industry reinventing itself? That’s an entirely different matter, and a process that typically takes place over a multiple-year stretch, prompted by many unpredictable and uncertain variables.

The COVID-19 pandemic, a singular event that sparked some of the most dramatic transformations we’ve witnessed since the dawn of the internet, triggered unprecedented paradigm shifts in every business sector practically overnight—particularly in the world of retail.

Retail underwent one of the most significant and wholesale shifts—an industry-wide digital transformation that irreversibly changed spending styles and shopper behaviour, perhaps forever.

Unlike other industries, retail didn’t immediately grind to a halt as consumer demand evaporated. Instead, many areas of the retail sector boomed after the initial shock of early lockdowns, especially when it came to online shopping for essential products such as groceries and other household commodities.

Overnight, 100% of consumer demand became 100% digital, and those without a robust online infrastructure or reliable eCommerce site were suddenly left in the lurch. Big online retailers were in a good position to react, possessing the agility and flexibility to re-channel much of their offline operations into their digital offering.

But smaller retailers suffered. While many possessed an online presence, digital was supplemental to their biggest revenue driver—in-person visits to physical stores.

We’ll likely never see a return to pre-pandemic shopping behaviour. In fact, many experts believe that the retail industry was already heading in a distinctly digital direction, with some saying the pandemic forced 10 years of technological acceleration and change on the sector within the space of a few months.

What’s clear is that the reinvention of retail and subsequent shifts in shopper behaviour are likely to be durable and permanent, making it vital small businesses work hard to achieve better online penetration to thrive in the new digital-first world.

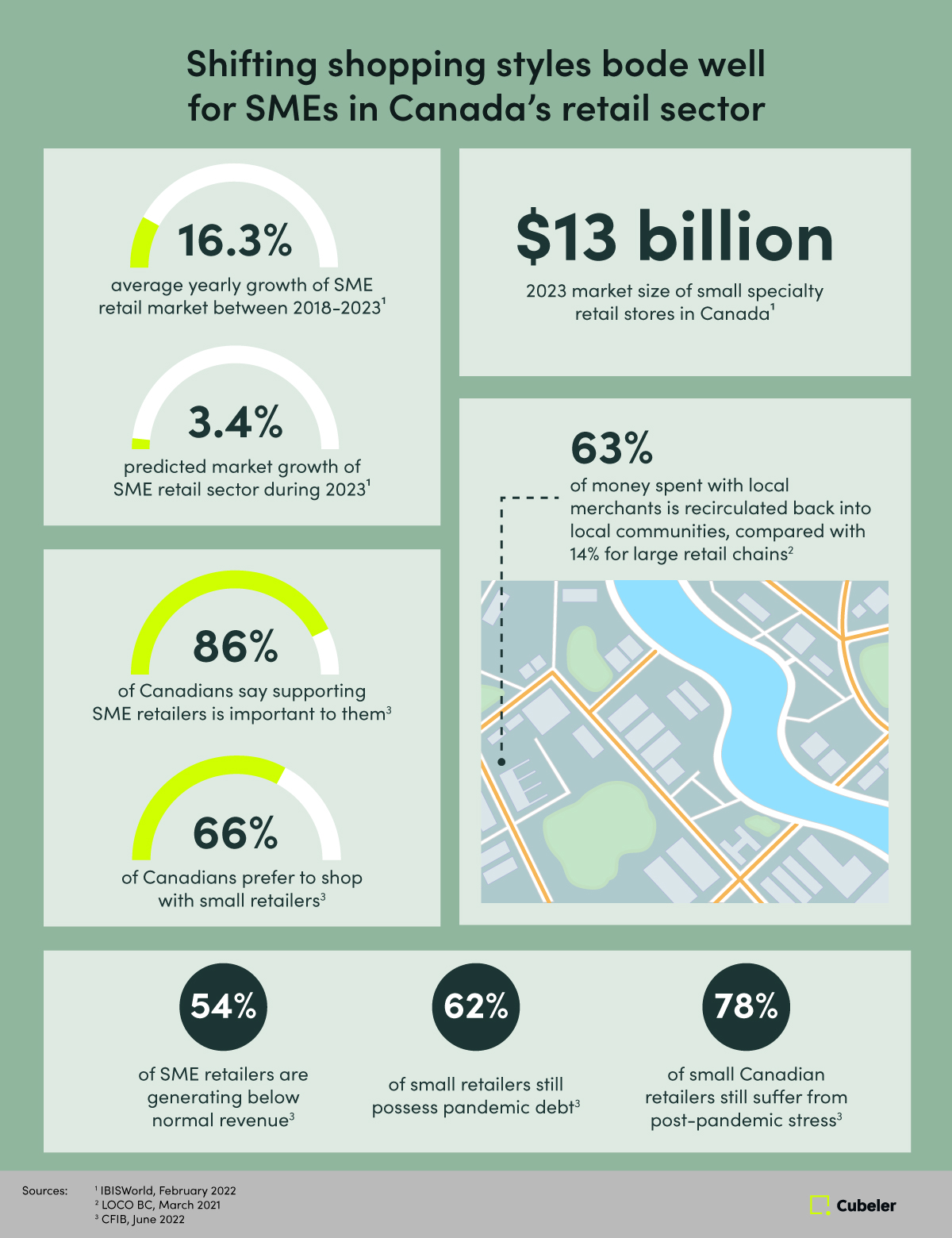

Data shows small specialty retail stores are worth $13 billion to the Canadian economy, growing on average 16.3% per year between 2018 and 2023.

Small retailers also represent a vital cog in the success and development of local communities—with a far more significant impact on local economies than bigger retail players.

Today’s research shows 63% of spend made at local retail businesses is recirculated back into surrounding community, compared to just 14% for large multinational retailers.

And since the pandemic, there’s been a major shift in consumer behaviour, much welcomed by SME owners in the retail space. In fact, research shows most Canadian consumers (86%) say supporting small businesses is important to them, while two-thirds (66%) state they often choose to shop at small retailers rather than ordering from large online brands.

Despite the recent boost in consumer sentiment and support, SME retailers are still suffering significant fallout from the pandemic, with 54% generating below their normal revenue, 62% carrying pandemic debt and 78% still feeling pandemic-related pressure.

What’s more, although the SME retail sector is set to enjoy more growth during 2023, it’s significantly lower (a 3.4% increase) than the yearly average between 2018 and 2023 (16.3% increase).

To continue accelerating growth, SME owners must make a concerted effort to cohesively connect their eCommerce and brick & mortar stores. Each possess their own distinct advantages and disadvantages when, put together, can transform a small retailer into an industry-leading powerhouse.

eCommerce |

Brick & Mortar |

|

Ultimate convenience: Shoppers don’t have to leave the comfort of their own home, and can shop any time of day, from any location. |

Sensorial factor: Consumers can physically touch items to determine quality and suitability. |

|

Ease of choice: Consumers can shop around multiple sites, comparing products and the latest deals to find the most suitable items and save money. |

Instant purchase: In most cases, consumers can immediately take their purchases home, rather than waiting for online delivery. |

|

Less pressure: Consumers don’t feel pressured by employees and can shop at their leisure without falling prey to dreaded impulse purchases. |

Faster returns: Mainly, shoppers can physically return items for immediate exchange or refund. |

|

Customer experience: For shoppers who find traffic, crowds and lines stressful, online retail often presents a more independent, relaxed shopping experience. |

Customer experience: For many, shopping in-store can be combined with other social activities, such as meeting a friend, helping boost well-being and mental health. |

|

Data & marketing: Online shopping allows retailers to collect more customer information and, in turn, understand buyer behaviour, which helps them develop more effective marketing campaigns. |

Personal connections: Physical stores allow small retailers to create authentic connections with repeat buyers, building vital customer loyalty. |

1. Price is nice, but convenience is key

Shoppers accept the fact that smaller independent stores usually charge more than large retailers, but they’re willing to foot the extra cost, as long as the convenience matches what multinational chains offer.

Small retailers can make small changes that pay big dividends when it comes to customer convenience, such as curbside pick-ups, easier return policies or multiple purchasing channels on social media platforms or other retail partners.

Headless commerce, a growing trend in retail, is when a brand completely separates its CMS (content management system) from its front-end delivery layer. This allows small retailers to advertise and sell products across multiple marketplaces and popular platforms (such as Amazon Alexa, Instagram or TikTok), without rebuilding their site.

2. In-store payment technology pays off

Post-COVID, consumers demand a more sophisticated technology experience from their favourite brands, and that extends to their in-store shopping experience.

According to McKinsey, the two types of in-store technology consumers want to see more are mobile payments and mobile app orders. More than 35% of consumers, however, say they’ve hardly seen even the most basic in-store technology while shopping. Clearly, there’s a gap between consumer expectations and brand delivery.

Tight budgets and strict resources are a constant concern for small retailers, but these are insights direct from your customers—investments in your technology will be key to remaining competitive in the years to come.

3. Customer loyalty, your biggest differentiator

One thing that separates smaller retailers from the bigger players is shopper loyalty. People will often go out of their way to buy from their local stores, because they feel it’s important to contribute to the local economy and their community.

Nevertheless, loyalty must be earned. SME marketers should consider introducing loyalty programs that reward repeat customers, send out exclusive and personalized invites to hosted community events and offer gifts or discounts for customer referrals.

4. Omnichannel is your new best friend

The digital and in-store experience are no longer separate entities. The hybrid customer experience has surged in importance since the pandemic ended, where data collected from in-store interactions is used to inform online strategies, and vice versa.

The more “consented customer information you collect, the better you’ll understand the shoppers who visit your store. For example, if some of your products aren’t performing well online, consider what you’ve learned about your customers to fix the situation—from offering them discounts to rewarding your most loyal ones.

5. Invest in immersive technology and experiences—online and offline

While big retail chains will always lead the way when it comes to new and emerging technology, that doesn’t mean smaller retailers can’t dip their toes in the waters of retail innovation.

Augmented and virtual reality technologies are now much more prevalent across the retail landscape, allowing consumers to, for example, try on clothes or see what furniture looks like in their home, without leaving the comfort of their couch.

Offline, small retailers can create more immersive experiences and raise awareness with pop-up stores at local markets, join/host community events, or even in-store masterclasses that build rapport with repeat customers.

6. Beware “tip-flation” and “tip creep”

Tipping culture is divisive and an ever-present topic for Canadians. Typically a staple of the restaurant and hospitality sector, it has started to creep its way into other areas of the service industry, including retail. And many people in Canada aren’t happy about it: research shows that 95% of Canadians think too many places ask for tips these days.

SME owners and managers should carefully consider the customer impact of including tipping prompts in their physical stores, because it could potentially negatively impact shopper loyalty and erode consumer trust.

So, what does the reinvention of retail mean to your business? Here’s what it means to your SME:

Don’t rely on post-pandemic consumer sentiment forever: While there’s been a clear shift in Canadian shopper behaviour, from frequenting multinational chains to favouring local retail stores, SME owners must work hard to remain competitive.

Invest in technology, online and offline: Prior to the pandemic, it was often one or the other for small retailers—brick and mortar store or eCommerce site. In the modern, digital-first era, both models must now work seamlessly together.

Small changes can make a big difference: While the reinvention of retail prompted a massive shift in a dramatically short period of time, SME owners still need to overhaul their entire business model, taking baby steps in the digital world to ensure their technology investments meet their business and customer needs.

Enhance your marketing expertise with our free Marketing Plan Workbook, tailored specifically for small business owners...

Find out what you need to know to bypass the most common marketing pitfalls.

Expand your SME business network the right way. Learn how to connect with like-minded SME owners and decision-makers to...