The 10 Biggest Supply Chain Lies Out There

Uncover the truth behind the 10 biggest supply chain management lies and achieve operational excellence with proven,...

Learn about the K-Shaped Recovery and how it affects SMEs.

The K-Shaped Recovery and Your SMEs Survival

There’s no question that the Covid-19 pandemic has affected SMEs across Canada disproportionately. Given that these small and medium-sized businesses have already been struggling with skill gaps, labour shortages, a battered economy, supply chain issues, inflation, and a looming recession, what happens to this sector touches absolutely everyone and everything.

Despite those daunting challenges, SMEs have continued to be the major drivers of Canada’s economic growth and private-sector employment. When 1.3 million small and medium-sized businesses employ more people than almost any other sector, it is important to understand that their survival is essential. But how do they do that and prosper?

Lately, economists are predicting that many SMEs could find themselves on the wrong leg of a K-shaped recovery.

What’s a K-Shaped Recovery?

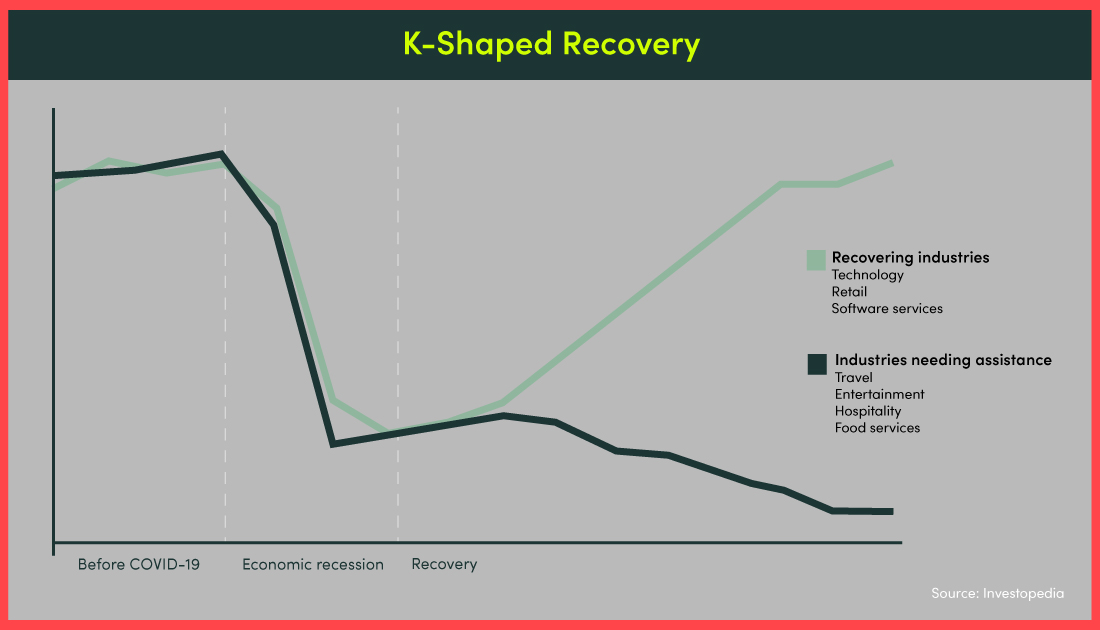

After an economic downturn, an economy’s various segments tend to recover at distinctly different rates, times, or sizes. It’s called K-shaped because, when charted together, the path of different parts of the economy can diverge, which ends up looking like the two arms of the letter “K.”

A K-shaped recovery brings changes in the economy’s structure as economic outcomes and relations are essentially changed before and after the downturn.

The K-shaped recovery term came about in 2020 following the sharp downturn in the United States during the COVID-19 pandemic. It was used to describe the patchy economic recovery experienced by a variety of sectors, industries, and the labour force.

A K-shaped recovery compares the paths of separate economic variables across society or employment in different industries, unlike the more commonly used letter-shaped descriptors of economic recessions and recoveries in the past.

A V-shaped recovery is illustrated as a steep rise back to a previous peak after a severe economic downturn or recession.

On the other hand, a U-shaped recovery shows the economy lagging over numerous quarters before finally returning to its previous status.

An L-shaped recovery happens at a slow rate and often includes persistent unemployment with sluggish economic growth.

Lastly, a W-shaped recovery shows a decline then a rapid rise upward followed by another steep decline to finally end up with a sharp rise.

K-Shaped Recovery Causes

The K-shaped recovery is the result of a recession or economic downturn that occurred at different speeds. As the K-shape symbolizes, the economy has been divided into two, based on characteristics such as geography, wealth, and industry.

The ongoing recovery from the COVID-19 pandemic is splintered and irregular. While millions of people became unemployed, the wealthiest grew their fortunes. The ICE360 Survey 2021, conducted by People’s Research on India’s Consumer Economy (PRICE), shows that, among other findings, that the wealthiest 20% of households have added more income as a group over the last five years than during any other preceding five-year period.

During COVID-19, industries such as restaurants, hotels, and the entertainment industries were hit hardest, while many other industries flourished as businesses switched to remote work. That alone increased sales of electronic devices as employees worked from their homes and the use of video conferencing tools for meetings skyrocketed.

How Canadians Are Reacting

Current economic data shows that the Canadian workforce, a vast majority employed by small and medium-sized businesses, are riding the K-shaped recovery in two different directions. White-collar workers continuing their jobs from home are on the upward path. Blue-collar workers facing unpredictable or shortened work hours or worse, a loss of income, are on the downward path.

Fortunately, the vaccination rollout has accelerated reopening, but the economy is not bouncing back as quickly as we’d like. Many permanent closures, lasting unemployment, and delayed investment are slowing the recovery. As early as May 2020, active businesses declined by 100,000 compared to the previous 12 months. More than half were in hotels, construction, personal services, food services, and retail.

On average, individual Canadians spent about $4,000 less during the pandemic. On the plus side, they saved nearly $6,000 per person. Along with the, albeit slow, reopening comes growing consumer confidence. You can expect Canadians to starts spending some of their savings, at first most likely in the travel and food services industries.

Seizing the Recovery for Your SME

All that pent-up consumer demand and spending power presents enormous opportunities for small and medium-sized businesses, but significant efforts are needed. Many SMEs are already effecting changes in this new normal. We’re seeing better protection for employee and customer health and safety with improved cleaning and disinfection procedures, cashless and contactless technologies, QR code menus, and more. Of course, there are always additional ideas to help your business.

Go All-in with Digital

More dramatic actions, such as digitization are major turning points for SMEs that haven’t yet made that necessary leap. Adapting business models and investing in new technologies to become more virtual, more mobile, and even global can accelerate a business’s recovery and set the stage for increasing revenues.

Online shopping grew considerably during the pandemic and is already becoming a new hard-wired consumer habit. Those SMEs that have taken their transactions online are winning big time. Restaurants that managed to survive when so many did not have invested in take-out and delivery programs that not only generated revenues, but built solid customer loyalty. They reworked their websites, created apps or partnered with services such as Uber Eats, SkipTheDishes and Door Dash to outsource their ordering and delivery services.

Ramp up Your E-Commerce

These days, most SMEs should have some sort of online presence depending on their investment capability. Creating your own e-commerce website is the best and most expensive way to go. Initial costs are website and e-commerce development, plus software and hardware. Ongoing costs are ISP, new or newly trained staff, maintenance, upgrades, and delivery.

SMEs with smaller budgets could work via Amazon, Google Shopping and Etsy for retail, DoorDash, Uber Eats, and SkipTheDishes for restaurants, and Tripadvisor, Expedia, and Airbnb for travel and lodging services. More than providing direct access to local, national and international markets, their flexibilities are excellent for product trials, promotions, and to keep an eye on your competition.

Social media platforms such as Facebook, Instagram, and even TikTok are easy to use and provide direct access to online communities at the cost of internet access. They’re good starting points for SMEs looking to get their feet wet (along with anecdotal proof of concept) with e-commerce.

Test, Experiment, and Adapt

Seizing your opportunity means testing the waters. Start with an option that fits your budget. When you’re confident about your offers and your customer base has grown, migrating or expanding will be more sure-footed.

If it feels daunting, you can find support, training, advice, and grants through the federal and provincial governments’ partnership program, Digital Main Street.

Takeaway

No matter the shape of the post-pandemic recovery – W, U, L, V, or K – small and medium-sized businesses first need to understand how they can stay afloat. A K-shaped recovery is most difficult for many SMEs but not insurmountable. Not only are those businesses the hardest hit by Covid-19 and the lockdowns, they can be buoyed by the reopening accelerated by vaccination programs and the enthusiasm most Canadians applied to changes in the way the world around them now works.

There are positives to offset the gloom of a global economic turndown – and even a predicted recession – as long as entrepreneurs and SMEs can maintain a steady drive forward that’s punctuated by cautious thought, meticulous planning, and intelligent courage. No business operates risk-free, but mitigating those risks must be part of your day-to-day efforts.

Summary

SMEs can survive and even thrive during a K-shaped post-pandemic recovery if they are equipped with relevant information and the right tools to keep business humming. In this article, we explain the reasons behind the current situation and offer ideas to help.

From explaining exactly what a K-shaped recovery entails and why it’s happening, to what your SME can do to protect the base business while moving forward along the upward arm of the graph, the solutions we offer are only a start. But the objective here is to stimulate and inspire your planning to keep your small or medium-sized business on track for a full recovery that leads to prosperity.

Uncover the truth behind the 10 biggest supply chain management lies and achieve operational excellence with proven,...

Discover how to sidestep the top 10 digital transformation fails with a step-by-step plan to integrate the right...

Enhance your marketing expertise with our free Marketing Plan Workbook, tailored specifically for small business owners...