Unlock the Power of Marketing: Get Your Free Marketing Plan Workbook

Enhance your marketing expertise with our free Marketing Plan Workbook, tailored specifically for small business owners...

With most economists advising Canadian SMEs to prepare for a recession in 2023, now’s the time to shore up your financials and manage—even increase—your debt with the goal of surviving the downturn. This way, you can come out the other side ready to propel your business to new heights.

Money makes the SME world go around, but the lack of it during a recession can put a temporary pause on your success. Is your SME positioned to survive an economic downturn?

Instead of fearing what may be inevitable, you can prepare for it with smart financial management and even increased debt. If that sounds reckless, we disagree.

Recently, economists have been forecasting a mild recession in 2023. But what is a recession? It’s typically defined by two consecutive quarters of negative GDP growth. And what does that mean for SMEs and their “bread and butter”—their customers?

Simply put, as the economy stalls, SMEs and their customers become very cautious about their spending. Your business could find it more difficult to generate and maintain your usual sales numbers, and you may need to cut costs.

This could be the first major downturn for you, so here’s what you can expect. For most small and medium-size businesses, a recession typically leads to lower cash reserves. Managing cash flow becomes exceptionally important during an economic downturn.

This may not be the time to batten down the hatches and wait it out. These things do pass, after all. In the meantime, taking a proactive approach to your financing—or lack thereof—may be the answer to weathering any recession storm.

How a small business loan can help you during a recession

There are both advantages and disadvantages to taking out a loan for your business during a recession.

On the positive side, it gives you options. If your SME is not flush with cash going into a recession and you see a slowdown on the horizon, you might have to start cutting your staff or budget.

A loan could help you maintain your forward-thinking strategies. And because you don’t know how long the recession could last—they average six to 12 months—the extra cash could provide the time you need to get your SME over the hump.

On the other hand, taking on additional debt may complicate things. The loan payment will affect the ability of your business to break-even from a cash flow perspective. Plus, a loan might cause you to delay certain business decisions you should have made sooner.

With extra cash on hand, you might delay changing a supplier or doing everything yourself, simply because you aren’t seeing or feeling how tight things could get.

If your business ceases to be profitable, you may have to cut costs instead of taking on more debt to cover your losses. A loan should never be used as a crutch. It’s best suited for seizing opportunities and, during a downturn, surviving as a business.

Why getting a business loan during a recession makes sense

In certain situations, obtaining a business loan during a recession can make a lot of sense, especially if you’re looking to consolidate other debt.

If you have credit card or personal loan debt, combining them into a new loan with a lower interest rate can be helpful. It doesn’t automatically increase the amount of total money you owe, but you may end up with better interest rates and repayment terms that can ease the short-term pain of a recession.

Why replace one type of debt for another? If you have multiple credit card debt balances at high interest rates, you may be able to refinance them with a consolidation loan at a lower interest rate.

Also, paying off just one consolidated loan is easier than managing multiple loan payments every month. If you cannot combine all your loans, focus on consolidating only high-interest loans.

Keep in mind that interest rates for consolidation loans can be fixed or variable. A fixed rate locks in lower interest costs during a recession, while a variable rate may lead to higher rates in the long run.

Additionally, just like many other types of loans, consolidation loans require borrowers to meet certain requirements. The interest rates you ultimately pay will depend on factors like your credit score, income and creditworthiness.

Consider a business loan as emergency cash

If you decide to take out a loan, do it for your SME’s survival until the economy recovers. Don’t spend it unnecessarily.

With extra cash on hand, you can make your monthly payments from the loan’s proceeds.

You can also use the loan for real emergencies or an attractive opportunity—like buying out a competitor, merging with another SME or taking your business in a new direction.

Getting business loans, lines of credit and credit cards during a downturn

You may be asking yourself: “Can I even get a loan during a recession?” Yes, but it depends. Lenders will tighten up their credit criteria during a recession, so you need to find lenders that are willing to lend now.

Banks offer many types of credit—from business loans to lines of credit and credit cards—and the right one for you depends on your specific needs. What are yours?

Starting a new business?

Scaling up an SME?

Purchasing equipment, technology or a building?

Acquiring another company or buying out a partner?

Prioritizing your needs can help you determine the best type of credit for you and how to make your case to a bank.

Boost your cash flow and keep your doors open

To avoid having to shut your doors, you might find yourself looking for ways to boost your cash flow during a recession.

As you saw in 2020, business can slow to a snail’s pace, caused by a perfect storm of external shocks that range from the COVID-19 pandemic to falling oil prices and inflation.

Although pundits south of the border believe that the U.S. is already in a recession, the Royal Bank of Canada (RBC) predicts that the Canadian economy is on track for a “mild recession” in 2023, thanks to GDP growth of less than one percent.

In Canada, real estate, jobless claims and the economic effects of pandemic restrictions are contributing to a slowdown and uncertainty.

In addition, rising interest rates and inflation numbers we haven’t seen in years are driving up the cost of everything from raw materials to labour and debt financing. This could lead to business closures and much tighter credit conditions.

If you’re dealing with cash flow issues, you may need to consider alternative financing solutions to boost your cash flow, so you can meet your payroll obligations, pay expenses and even take on new projects to grow your business—albeit cautiously.

Managing your cash flow during a recession

So, exactly how do you boost your cash flow without taking on more debt during a recession? It starts with examining your cash flow management and conducting an analysis to determine where to cut and where to streamline. You may also discover where to maximize additional revenue.

Consider these cash flow boosters:

Just be aware that credit card debt is unsecured. Payment terms are short. If you fail to make your credit card payments according to the credit card agreement, you may have to pay off the entire balance at a high rate of interest.

Getting a business loan…even with a bad credit score

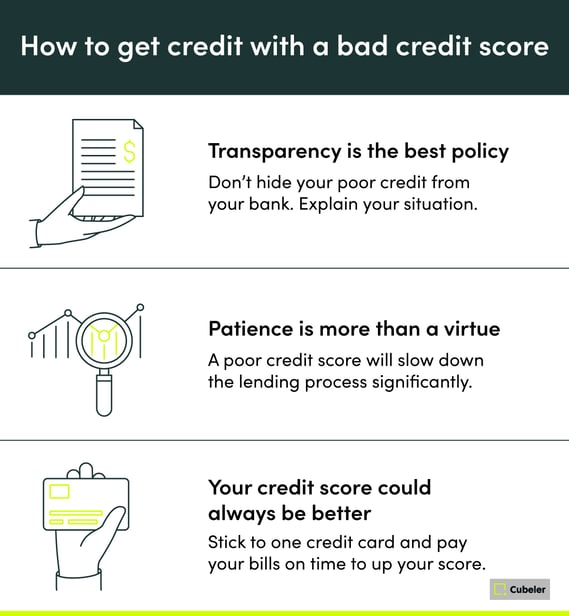

Poor credit will make obtaining a loan more difficult, but not impossible.

Banks typically look at many factors before approving your business loan. They want to understand your business needs and vet the project that the loan will finance, examining your SME’s current financial situation, your personal credit score and net worth.

In a recent BDC article, Darryl Curtis, a BDC Business Centre Manager, got right to the gist of the matter: “A business’s financial situation is the most important factor we consider when deciding whether to approve a loan...If a business is super strong, growing and has positive long-term prospects, the owner might have a bad personal credit rating and still get a loan.”

So, what do you need to do to obtain a loan with a bad credit score?

Manage your debt to better protect your business

During a recession, and even before one is officially declared, it’s more vital than ever to be proactive in managing your business debt. Your entire business reputation and credit are at stake. Consider these tips:

Quick Takeaways

A looming recession—even a so-called “mild” one—can strike fear in the hearts of SME owners. Right now, it may seem counterintuitive to prepare for the economic downturn by going deeper into debt. It’s not. A small business loan gives you options.

If your SME is not flush with cash going into a recession and you see a slowdown on the horizon, financing could be just what you need to stay afloat during a major downturn. Here’s why:

Recessions can last six to 12 months—the extra cash could provide time for your SME to survive in the interim.

Obtaining a business loan during a recession can make sense, especially if you’re looking to consolidate other debt.

If you have multiple credit card debt balances at high interest rates, you may be able to refinance them with a consolidation loan at a lower interest rate.

Use a business loan for real emergencies or a unique opportunity—with extra cash, you might consider buying out a competitor or partner.

Alternatively, manage your cash flow with peer-to-peer lending, a line of credit or a government-subsidized small business loan.

Enhance your marketing expertise with our free Marketing Plan Workbook, tailored specifically for small business owners...

Find out what you need to know to bypass the most common marketing pitfalls.

Expand your SME business network the right way. Learn how to connect with like-minded SME owners and decision-makers to...